Amazon Vendor Central vs Seller Central: Strategic Brand Growth Guide

Choosing between Amazon Vendor Central vs Seller Central is one of the most important strategic decisions brands face when scaling on Amazon. While both platforms allow you to sell products on the marketplace, the business model, profitability, control & long-term growth potential are completely different. RootAMZ specialises in helping brands navigate this critical decision & optimize their Amazon strategy for maximum profitability.

Understanding Amazon’s Two Selling Models

Amazon operates with two core supplier ecosystems that fundamentally shape how your brand interacts with customers & manages profitability.

Vendor Central (1P – First Party)

In the Vendor Central model, you sell wholesale directly to Amazon. Amazon becomes the retailer, purchasing your products in bulk & taking complete ownership of the customer relationship. Amazon issues purchase orders based on their demand forecasting, then sets retail pricing independently. Products appear as “Ships from & Sold by Amazon.”

Seller Central (3P – Third Party)

Seller Central represents the marketplace model where you sell directly to consumers through Amazon’s platform. You maintain control over pricing strategy, fulfilment decisions & inventory management while leveraging Amazon’s massive customer base.

The Core Difference

Vendor Central: Selling TO Amazon (B2B wholesale) Seller Central: Selling THROUGH Amazon (B2C marketplace)

This difference cascades into every aspect of your Amazon strategy, from profit margins to brand control to long-term scalability.

Amazon Vendor Central Deep Dive

Vendor Central access is invite-only. Amazon selectively chooses brands it wants to purchase inventory from, typically prioritising established brands with proven sales history.

Key Benefits of Vendor Central

- Enhanced credibility when products show “Ships from & Sold by Amazon”

- A+ Premium Content with immersive visual storytelling beyond standard Seller Central features

- Operational simplicity without managing fulfilment logistics or customer service

Vendor Central Challenges

Amazon controls pricing completely, creating race-to-the-bottom risk. Amazon frequently discounts aggressively without your input, potentially devaluing your brand equity. RootAMZ helps brands understand these pricing dynamics & develop strategies to protect brand value even within Vendor Central constraints.

Amazon Seller Central Deep Dive

Seller Central is open to all brands & allows direct selling without invitation requirements.

Key Benefits of Seller Central

- Full pricing control based on your margin requirements & brand strategy

- Better advertising flexibility with complete access to Sponsored Products, Sponsored Brands & Sponsored Display

- Stronger brand ownership through direct customer relationships & control over product detail pages

- Higher profit margins by retaining retail pricing power

Seller Central Challenges

- More operational responsibility for inventory forecasting & replenishment

- FBA fees & inventory planning complexity

- Customer service & account health management requirements

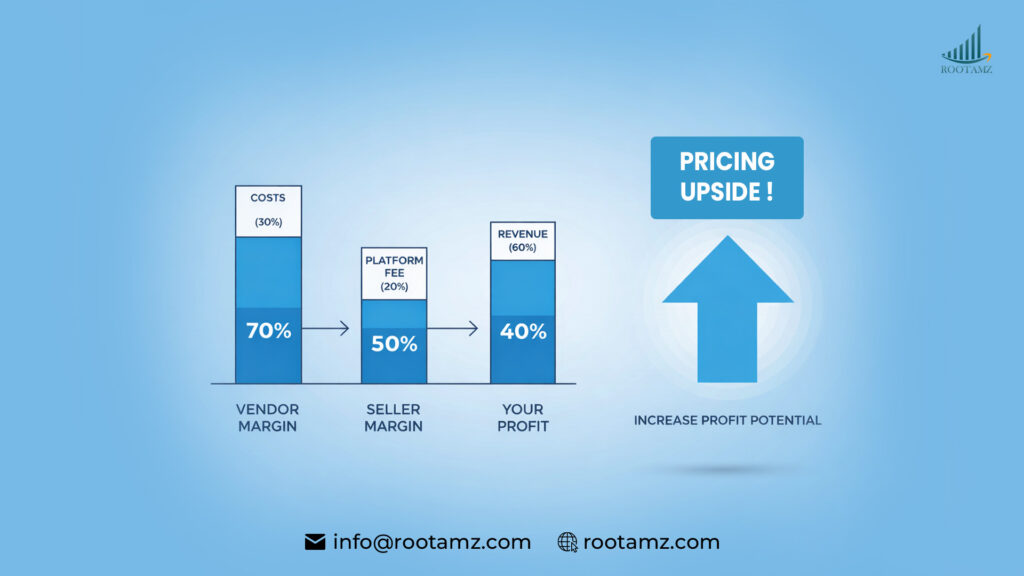

Profitability Impact: The Real Difference

The profitability gap between Vendor Central & Seller Central often determines long-term business viability. RootAMZ conducts detailed profitability analysis for brands evaluating both platforms.

Vendor Central Profitability Example

- Amazon purchases at $10 wholesale cost

- Your COGS: $6

- Your profit: $4 per unit (40% margin)

Seller Central Profitability Example

- Retail price: $24.99

- Amazon fees: $7.25

- Your COGS: $6

- Your profit: $11.74 per unit (65% margin)

Seller Central delivers nearly 3x higher profit than Vendor Central for the same product.

Brand Control & Buy Box Ownership

Vendor Central Brand Challenges

Vendor Central brands lose control when Amazon discounts aggressively during promotional events, often positioning premium brands at discount price points that damage long-term brand equity.

Seller Central Brand Advantages

- Maintain control over MSRP strategy across all retail channels

- Test & optimize listings without vendor manager approvals

- Defend minimum advertised pricing (MAP) by controlling your own listings

Inventory & Forecasting Differences

Vendor Central Inventory Risk

Amazon purchase orders fluctuate unpredictably based on proprietary algorithms that remain opaque to vendors, creating planning challenges.

Seller Central Inventory Control

Seller Central brands forecast based on controllable variables:

- Sales velocity trends from past 30-90 days

- Seasonal patterns specific to their products

- Advertising strategy & budget allocation

- Expansion goals into new variations

RootAMZ provides inventory management systems that help sellers optimize stock levels & prevent costly stockouts or excess inventory fees.

Advertising & Marketing Flexibility

Vendor Central Advertising

Access to Amazon DSP (Demand Side Platform) enables display advertising across Amazon’s network & external websites for retargeting & awareness-building.

Seller Central Advertising

- Complete Sponsored Ads control with granular targeting

- Launch campaigns within minutes & adjust bids hourly

- Calculate exact ACoS for individual keywords & campaigns

- Direct attribution between ad spend & sales

RootAMZ develops customized advertising strategies that maximize ROI while maintaining healthy profit margins.

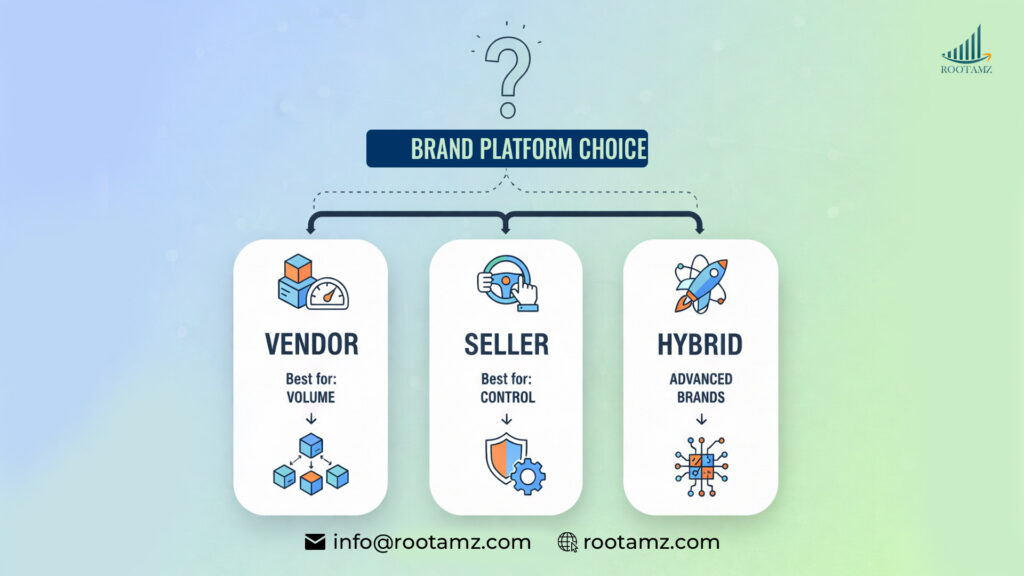

Which Platform Is Better for Your Brand?

Vendor Central Is Best If:

- You want wholesale simplicity without operational complexity

- Amazon provides consistent large orders justifying wholesale margins

- You have limited operational resources for inventory management

Seller Central Is Best If:

- You want maximum profitability through margin control

- You need pricing & brand control to protect brand equity

- You plan long-term marketplace growth beyond Amazon’s wholesale priorities

The Hybrid Strategy: Best of Both Worlds

Hybrid Model Structure

Some advanced brands combine both platforms, using Vendor Central for high-volume products & Seller Central for products requiring tighter margin control.

Hybrid Model Risks

- Duplicate listings creating suppression issues

- Buy Box conflicts when algorithms detect the same seller on both platforms

RootAMZ helps brands structure hybrid systems correctly, avoiding common pitfalls while capturing benefits from both models.

Technology & Automation for Platform Success

Vendor Analytics Tools

- Track chargebacks & compliance failures

- Monitor co-op fees & promotional deductions

- Analyse purchase order performance metrics

Seller Central Automation

- Inventory forecasting systems preventing stockouts

- Automated repricing for competitive positioning

- Profit dashboards consolidating all expenses

- PPC optimization tools maximising advertising ROI

Conclusion

The decision between Amazon Vendor Central vs Seller Central determines your profit margins, brand control & long-term marketplace leverage.

Vendor Central provides wholesale simplicity but sacrifices pricing control & profitability. Seller Central provides maximum growth potential with substantially higher margins for brands that master operational execution. RootAMZ helps brands choose the right model & scale profitably through strategic planning, operational excellence & technology implementation.

✅ Amazon Vendor Central vs Seller Central: Choose the Best Growth Strategy in 2026.

FAQ’s

Which platform is more profitable?

Seller Central is typically more profitable because brands control pricing & retain higher margins compared to wholesale vendor pricing. RootAMZ provides detailed profitability analysis showing that Seller Central often delivers 2-3x higher profit per unit compared to Vendor Central for the same products.

Is Vendor Central better for big brands?

Vendor Central is often offered to large brands, but many still prefer Seller Central due to stronger control & better long-term profitability. RootAMZ works with brands of all sizes to determine the optimal platform strategy based on specific business objectives rather than brand size alone.

Can a brand use both Vendor & Seller Central?

Yes, some brands operate a hybrid model, but it requires careful management to avoid pricing conflicts & listing suppression. RootAMZ specialises in structuring hybrid strategies that maximize benefits from both platforms while avoiding common pitfalls like duplicate listings & Buy Box suppression.

Which platform gives more control over branding?

Seller Central provides significantly more control over pricing, inventory, advertising & brand positioning. RootAMZ helps brands leverage this control to build sustainable competitive advantages & protect brand equity across all sales channels.